Zeekr sees Q3 net loss drop 84.9% on rising sales, falling costs

-

Zeekr sees Q3

- The Zeekr Group posted a net loss of RMB 307 million ($43 million) in the third quarter, a 84.9 percent decrease from RMB 2.028 billion in the third quarter 2024.

- Zeekr Group saw its vehicle deliveries increase by 12.51% year-on-year in Q3 while its R&D expenses dropped 8.6%.

With increasing deliveries and decreasing R&D expenses, Zeekr Group (NYSE: ZK) narrowed its third-quarter loss substantially.

According to unaudited results released today, the Group’s net loss for the third quarter was RMB 307 million (US$43 million), narrowing sharply by 84.9 percent from RMB 2.028 billion in the third quarter 2024 and decreasing 7.0 percent from RMB 287 million in the second quarter 2025.

The adjusted net loss excluding stock-based compensation expenses for the third quarter was RMB 265 million, down 86.6% year-on-year and up 3.1% quarter-on-quarter.

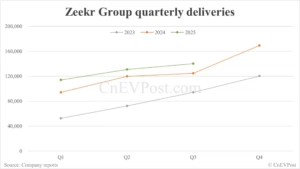

During the third quarter, Zeekr Group delivered 140,195 vehicles, representing a 12.51 percent increase year-on-year and a 7.13 percent rise quarter-on-quarter.

The Zeekr division

The Zeekr division sold 52,860 units in third quarter, down 3.90% year-on-year but growing 7.14% quarter-on-quarter. Lynk & Co sold 87,335 vehicles in the quarter, up 25.48% from the same period last year and 7.12% quarter-on-quarter.

The research and development expenditure of Zeekr Group within the third quarter reached RMB 2.74 billion, dropping 8.6 percent from a year ago but increasing 27.8 percentage from the previous quarter. Selling, general and administrative (SG&A) expenses for the third quarter were RMB 3.78 billion, an increase of 11.3% year-over-year and 12.5% quarter-over-quarter.

The increases in SG&A expenses was mainly due to higher marketing and advertising expenses related to the support of new model launches and sales growth, said Zeekr. The third quarter gross margin was 19.2%, better than the 15.2% in the third quarter of 2024 but lower than 20.6% in the second quarter of 2025.

Vehicle margin for the third quarter was 15.6 percent, up from 12.6 percent in the third quarter of 2024 but down from 17.3 percent in the second quarter.

Zeekr Cuts Q3 Net Loss by 84.9% as Sales Surge and Costs Decline

⭐ Phase 1: Introduction – Strong Turnaround in Q3

Zeekr, the premium electric vehicle (EV) brand under Geely, reported a major improvement in its financial performance for the third quarter. The company achieved an 84.9% reduction in net loss, marking one of its strongest quarters yet. This improvement came at a time when the EV market is experiencing intense competition and pricing pressure, making Zeekr’s performance even more noteworthy.

⭐ Phase 2: Rising Sales Drive Revenue Growth

A key driver behind Zeekr’s improved financial performance was its sharp rise in vehicle sales. The company continued to expand its customer base with popular models like the Zeekr 001, Zeekr X, and Zeekr 009. Strong demand in domestic markets and a growing presence in overseas markets boosted total deliveries.

Higher deliveries translated into robust revenue growth, with the company reporting significantly higher year-on-year sales volumes. Increasing consumer trust in premium EVs, along with Zeekr’s focus on design, performance, and advanced EV technology, contributed to this rise.

⭐ Phase 3: Falling Costs Improve Profit Margins

Another important factor behind the 84.9% drop in net loss was the reduction in operating costs. Zeekr has been steadily improving its production efficiency, optimizing its supply chain, and leveraging economies of scale. As production volume increased, cost per vehicle decreased, helping the company strengthen its margins.

Additionally, the company implemented strategic cost-cutting measures across R&D, operations, and marketing without compromising product quality. This helped Zeekr keep its expenses under control even as it expanded.

⭐ Phase 4: Market Outlook and Future Strategy

Looking ahead, Zeekr aims to expand its global footprint, especially in Europe and the Middle East. With new models in development and continued innovation in battery technology, the company is focusing on long-term growth. Zeekr’s strong Q3 performance has boosted investor confidence and positioned it as a rising competitor in the global EV industry.

⭐ Conclusion

Zeekr’s sharp reduction in Q3 net loss highlights a successful combination of rising sales and falling costs. As the company continues to scale and innovate, it is well-positioned to strengthen its presence in the fast-growing EV market.